There’s treasure at the bottom of the ocean – quite literally. About halfway between Hawaii and Mexico, on the Pacific abyssal plain, lies the Clarion-Clipperton Zone (CCZ), site of one of the greatest mineral bonanzas on earth. Here, across an area twice the size of Kazakhstan, the seabed is liberally scattered with trillions of chunks of valuable metals. Known as polymetallic nodules, their presence here has been known since HMS Challenger dredged a few up during a scientific expedition in the 1870s. However, their true value has only recently become apparent, and now the race is on to bring them to the surface.

The metals that make modern life possible

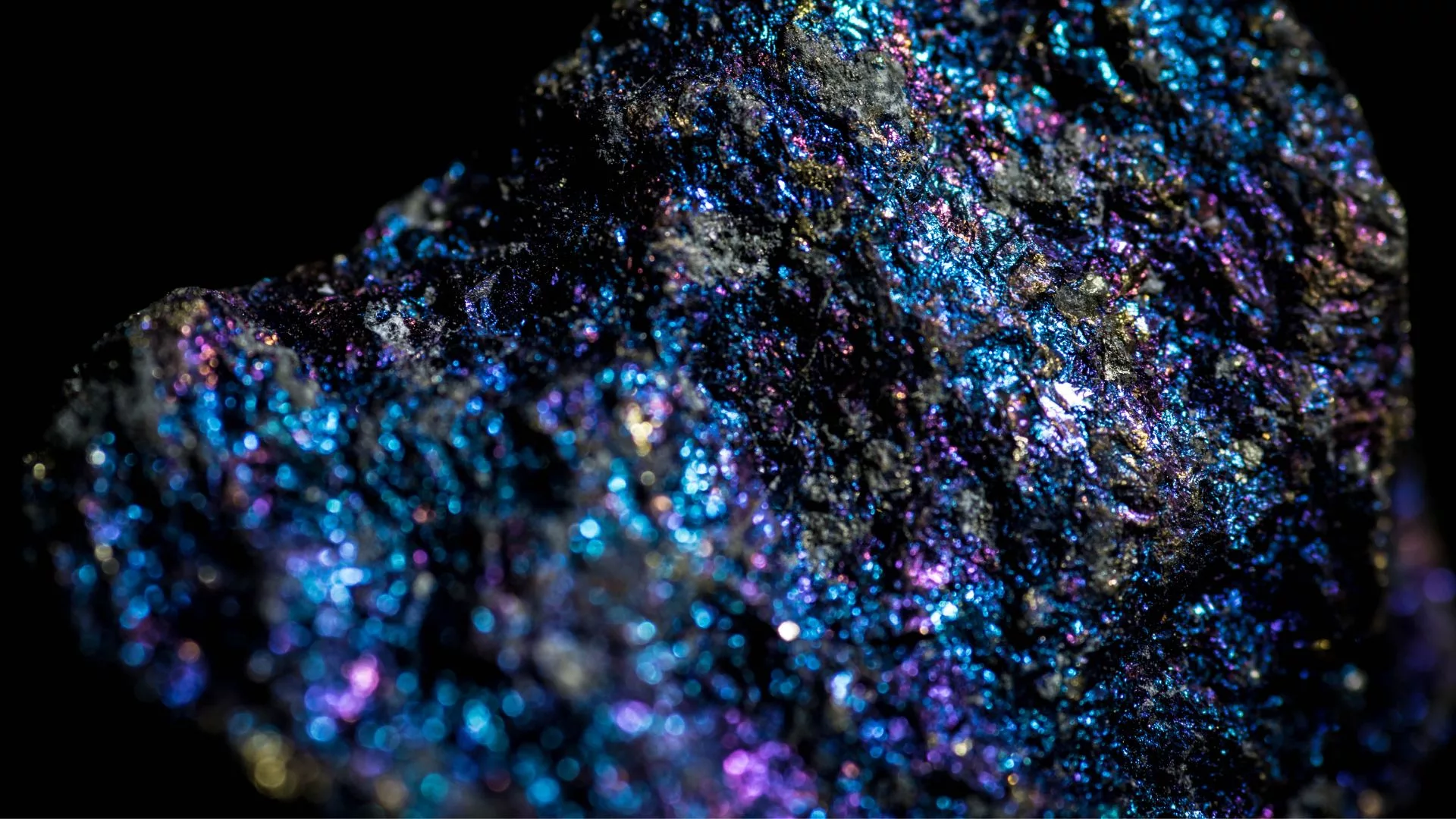

The nodules, between the size of an apple and a potato, are made of high-quality cobalt, nickel and manganese, among other minerals. Though not rare earths, all three are considered critical minerals. There’s no avoiding it: they are essential to both the green energy transition and the maintenance of modern life. Without cobalt, nickel and manganese, we couldn’t have stainless steel, performance alloys, batteries, electric cables, circuit resistors, car engines, gas turbines, smartphones, computers, fertiliser or jewellery. As the economist Ed Conway has pointed out, the ethereal economy where many of us spend our time and make our money – sending emails, swapping ideas and moving numbers about – is utterly reliant on just a handful of minerals, and we ignore this at our peril. What’s more, we will soon need lots more of them. If we are serious about making the much-vaunted transition to clean energy, our requirements for critical minerals will increase at least six-fold. Consequently, China, Japan, the UK, the US and the EU have all identified access to the three metals, among others, as vital to their national interests. Any new sources attract immediate attention: not least the CCZ, which recent surveys have suggested holds more cobalt, manganese and nickel than all terrestrial sources combined.

What makes the nodules in the CCZ so interesting is their mineral purity and relative ease of access. Cobalt, nickel and manganese are reasonably abundant on the surface, but only as ores. Huge amounts of earth need to be dug up and processed to get at the minerals, with significant environmental consequences. An idea of the processing required can be had by looking at the prices for ore, alloy and pure metal. A metric ton of Australia’s finest manganese ore can be yours for just $5; but good luck doing anything with it: it’s mostly dirt. Once it has been processed (invariably in China; trade prices are set in Guangxi, Hunan, Guizhou and Chongqing), then the pure metal trades at around $1700 a ton – an impressive 33,900% increase. This value-add is the result of an expensive, energy-intensive refining procedure that China has specialised in over the last forty years. By contrast, the CCZ nodules offer a higher mineral purity: rather than shovelling ten tons of ore into a blast furnace to get a few hundred kilos of pure metal, a smaller amount of ground-up nodules could be processed into a similar amount of end-product metal.

Environmental, social and strategic risks of critical mineral extraction

The resources in the CCZ have a further draw: it may be less damaging to the environment and society, and more strategically sound, to extract them than to continue mining as we currently do. Mining on the surface is usually open-cast, leading to mass deforestation and other forms of environmental degradation. While manganese and nickel are fairly uncontroversial – most come from professionally run mines in South Africa, Gabon, China, Australia and India – the same can’t be said of cobalt. The majority comes from the war-torn Democratic Republic of Congo, from what are politely referred to as ‘artisanal mines’ – that is, dangerous, crudely-dug, often illegal operations, staffed by children who hack the metal out of flooded trenches with hand tools. Their digging is not only dangerous, but poisons rivers and agricultural land too. Tragically, this situation is unlikely to change: Congo, with an estimated 6 million tonnes of cobalt, holds fully half of the world’s reserves. Only Australia has anywhere near the reserves to compete, with an estimated 1.7 million tonnes – but for now, it only produces a scant 5,900 tonnes a year, while the Congo pumps out 130,000.

And that’s only the human impact; there are strategic concerns too. A flurry of recent white papers, books and think pieces has highlighted a key weakness in Western industrial policy: we desperately need critical minerals but don’t have the infrastructure or the skills to secure our own supplies. While Australia can provide huge quantities of minerals, from mundane iron ore to valuable rare earths, it could not meet demands by itself. Much of the world’s mineral bounty is in conflict zones like Congo or Ukraine, or held and processed by countries like China and Russia, with whom the Western alliance have increasingly tricky relationships. Across the West, mines have been closed for decades, and national skill bases have atrophied. The simple truth is that even when we find deposits in our own countries – like the recent discovery of what is suspected to be the world’s largest lithium deposit in California – we often don’t have enough people who know how to extract or use them, and certainly don’t have the refineries ready to roll. In an era where more and more critical minerals are required, this is downright foolish.

Chinese mineral strategy: impacts and implications

China has allowed no such thing to happen. It processes between 75% and 98% of the world’s supply of rare earths; produces more iron and steel than anywhere else on earth, and trains tens of thousands of new mineralogists, metallurgists and engineers every year (there’s a reason the global rankings for geology and materials science are dominated by Chinese universities and Chinese students). Beijing has also implemented a sensible, far-sighted minerals policy, striking deals to buy up supplies across Africa, Central Asia and the Indo-Pacific, often locking in decades-long contracts. These minerals have been the key to China’s recent electric vehicle surge – Chinese industry already had the capacity and the skills base to rapidly scale up production of giant lithium-ion batteries, and now has the raw materials too. From extraction to processing to brokerage, sale and use, Chinese firms have established a formidable lead. When it comes to rare earths, there is now really only one game in town. The West has much to learn from China, which has nimbly taken the lead on not only rare earths, but also on closely associated industries like electric vehicles and electronics manufacturing.

Mining the CCZ: we can, but should we?

This brings us back to the CCZ. Here, we find something little short of a geological miracle: trillions of chunks of high-quality critical minerals, that would need less refining than terrestrial ore, conveniently located in international waters just waiting to be gathered up. So, what’s the hold-up? There are, undoubtedly, some technical issues: the nodules are all between 2000 and 4000 metres down, in complete darkness and under crushing pressure. (Consider the fate of the Titan submersible to get an idea of what it’s like down there). But extracting them is within the realm of possibility: we have the technology, and have since the 1970s, when Lockheed Martin first pioneered it (initially as a cover story for an ambitious attempt to steal a sunken Soviet submarine for the CIA). Mining ships would deploy enormous hoovers to trawl the seabed and suck up the valuable rocks. These could then be crushed and processed onboard, before the ship sails off to a conveniently-located refinery. The ships are ready to go and could be on-site in weeks: one from the Canadian firm The Metals Company is already there, conducting research. The obstacles are not technical, but legal. Their resolution depends on a number of tiny, but stubborn, island nations, climate scientists and international bureaucrats.

In the 1970s, the first rush to the CCZ foundered against the rocks of the anti-colonial movement. A critical speech by a Maltese representative at the UN, comparing the nascent undersea gold rush to the worst excesses of the nineteenth century, led to the establishment of the International Seabed Authority (ISA), an intentionally obscure outfit based in Jamaica. The UN did what the UN does best, and set up a tangle of new laws and regulations to manage the impacts of any deep-sea mining, stymieing progress for decades.

While some of the aims of the resulting legislation are laudable – such as a requirement for the protection of animals and other sea creatures, and the insistence that anything dug up in international waters should be for the benefit of all mankind – the fingerprints of the anti-colonialists are hard to miss. For every licence to drill the ISA hands out to a big corporation or major power – usually for 750,000 square kilometres at a time – an equally sized, equally promising slice of seabed must be given to a minor country. Thus, superpowers like China that actually have the money, talent and ability to harvest critical minerals, find themselves holding as much promising territory as microstates like Nauru, Tonga and Samoa, many of whom have long held up drilling efforts. (The US, uniquely among major powers, is prevented from claiming any stakes in the CCZ, since Washington refuses to ratify the UN Law of the Sea – ironically, because of a dispute about deep sea mining. Instead, American companies buy the rights to mine in British claims). Arguments for and against have dragged on for nearly fifty years now: a real-life mineral version of Jarndyce v Jarndyce. In a quest to ensure fairness, mankind may have missed an enormous – and time-critical – opportunity to switch away from fossil fuels. Rarely have well-intentioned talking shops had such potentially dire impacts.

What you make of the arguments for and against drilling in the CCZ depends on your priorities. What is more important – making the bold leap to clean energy, or preserving the status quo, however unsustainable in the long run, from fear that the alternative might be worse? Those opposed to mining – France, Canada, Portugal, Spain, Mexico, and many of the smaller Pacific islands – argue that the environmental impact of trawling up the metals in the CCZ is poorly understood, and potentially catastrophic. (Indeed, some 5,000 new species have been discovered in the CCZ alone). Supporters of mining – including the UK, Norway, China, Japan, Russia and (unofficially) the US – argue that the pressing need for critical minerals to stave off the worst impacts of climate change outweighs the environmental impact of their extraction. Terrestrial supplies are dwindling, and have their own consequences: why, some ask, is it worse to hoover up rocks from the seabed than it is to strip-mine away whole jungles? The most ardent proponents of deep-sea mining privately complain of being held up by small minds in small countries – but, thankfully, progress is being made. This year will be, if you will pardon the pun, critical.

The ISA is decidedly liberal about handing out licenses for research – every single one of the 31 applications made to explore the seabed so far has been approved – but mining and extraction are another question. Despite half a century of stalling and talking, no clear regulations actually exist. The most recent effort to start mining, made by Nauru at the behest of The Metals Company, which has rented the rights to their seabed stake, was spiked by nearby Tonga – ostensibly on environmental grounds. This triggered a two-year waiting period, during which the ISA is required to draw up rules for deep-sea mining. The moratorium expires this summer, and those who follow critical minerals closely are holding their breath to see what happens next. So should everyone with an interest in the transition to clean energy. The fate of the world really just might hang on a few tiny island nations, a UN quango, and a handful of companies with the technology to change the world.

- Sean Paterson

- Sean Paterson

- Sean Paterson

- Sean Paterson

- Sean Paterson

- Sean Paterson

- Sean Paterson

- Sean Paterson

- Sean Paterson

- Sean Paterson

- Sean Paterson

- Sean Paterson